Why Private Credit?

Private credit refers to non-bank lending, where capital is provided directly to borrowers outside the traditional banking system. The asset class has experienced exponential growth in the wake of the global financial crisis, as regulatory constraints limited banks' ability to lend — creating a structural opportunity for alternative capital providers.

Today, private credit has become a highly sought-after segment of the market, attracting leading institutional managers who are shifting away from traditional fixed income and toward floating- rate, collateral-backed strategies that offer enhanced yield and lower interest rate sensitivity.

Adnate Capital seeks to democratize access to this evolving asset class. Through Adnate Credit Opportunities Fund I (ACOF I), we aim to deliver strong, risk-adjusted returns with meaningful downside protection, giving investors exposure to senior secured credit in U.S. middle market companies — a segment defined by durable cash flows and strong structural protections.

Why Is Private Credit Attractive Now?

Private Credit's Rapid Expansion: The asset class has grown from ~$100 billion in 2000 to over $2 trillion by 2024, fueled by the retreat of traditional bank lenders and rising institutional demand.

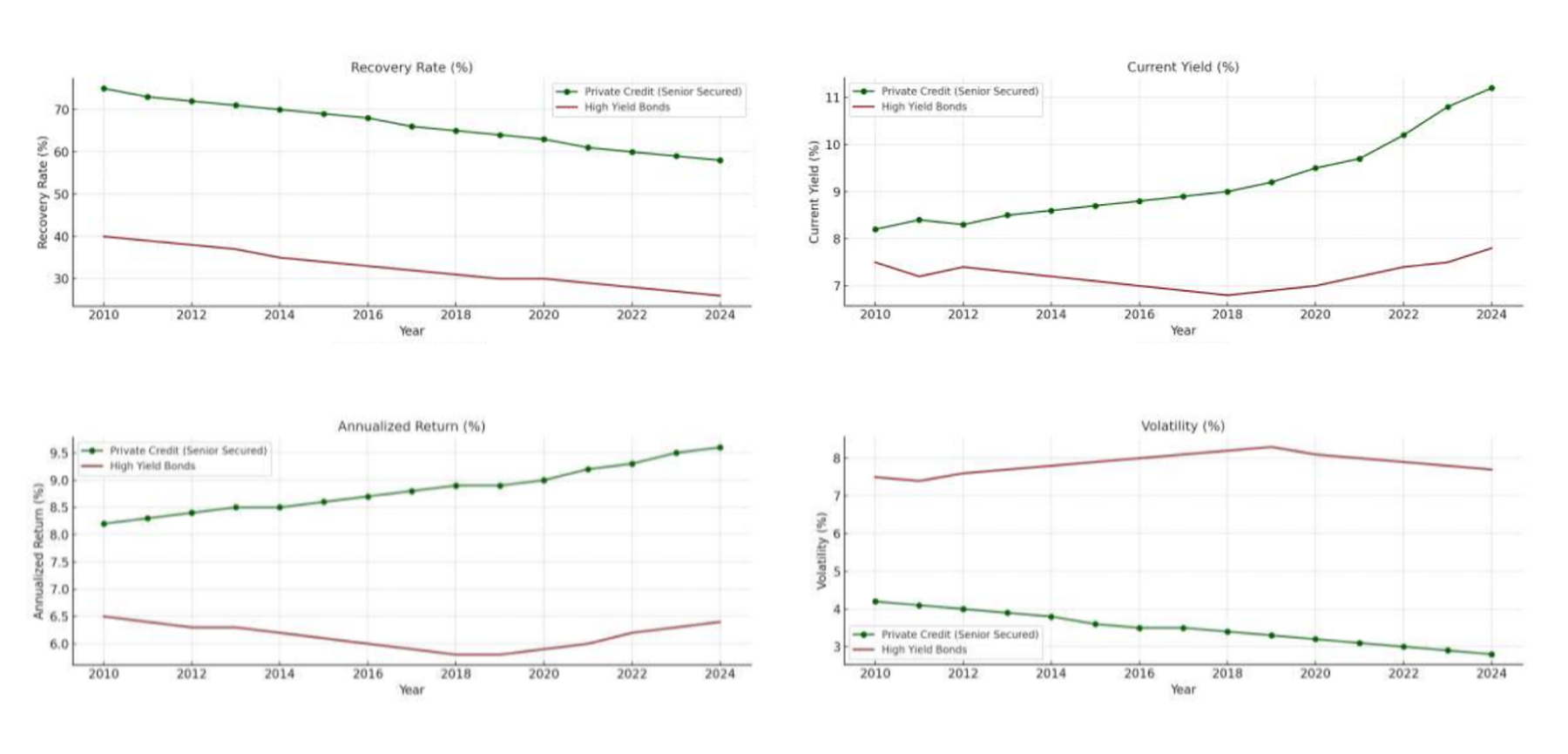

Attractive Risk-Adjusted Returns: Private credit offers higher yields than public fixed income, with lower volatility, senior secured positioning, and protection against rising rates through floating-rate structures.

Compelling Market Tailwinds: Inflation, higher interest rates, and evolving borrower needs continue to drive robust growth, with private credit AUM projected to surpass $3 trillion by 2028.

Accelerating Institutional Adoption: Investors are increasing allocations to private credit for diversification, downside protection, and stable, recurring income streams.

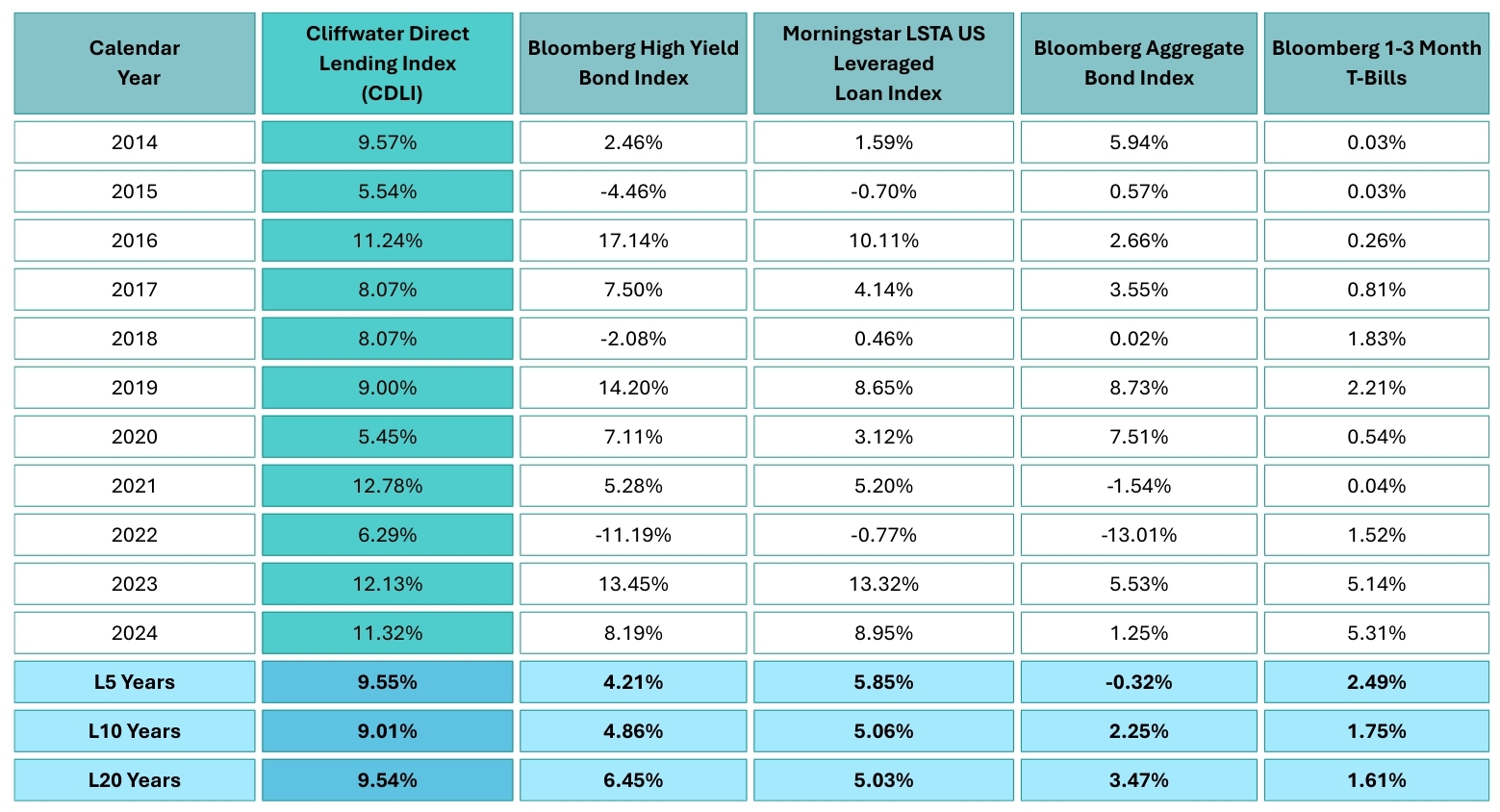

How Has Private Credit Performed?

Private credit has consistently outperformed traditional fixed income, delivering attractive risk-adjusted returns across market cycles.

Low Volatility

Historically, lower volatility than public high-yield bonds and equities, driven by senior secured positioning and private market protections.

Resilience Across Cycles

Demonstrated strong downside protection during periods of economic stress, including the Global Financial Crisis and COVID-19 dislocation.

Superior Recovery Rates

Senior secured private loans have historically achieved higher recovery rates than unsecured high-yield bonds, enhancing principal protection.

Attractive Risk Premium

Offered an illiquidity premium over public markets, rewarding investors with higher yields and stable cash flows in exchange for longer investment horizons.

How Resilient is Private Credit?

Senior secured private credit has delivered historical recovery rates of 65–70%, significantly outperforming unsecured high-yield bonds, which average around 40% recovery (Moody’s, 2024).

Higher recoveries are driven by first lien seniority, strong collateral packages, tight loan covenants, and direct negotiation rights that allow lenders to exert greater control during workouts or restructurings.